In his 2023 federal budget, President Joe Biden proposed a "billionaire minimum income tax" -- a 20% levy on households worth at least $100 million (which make up around 0.01% of Americans):[1]

Proposes a New Minimum Tax on Billionaires. The tax code currently offers special treatment for the types of income that wealthy people enjoy. This special treatment, combined with sophisticated tax planning and giant loopholes, allows many of the very wealthiest people in the world to end up paying a lower tax rate on their full income than many middle-class households. To finally address this glaring problem, the Budget includes a 20 percent minimum tax on multi-millionaires and billionaires who so often pay indefensibly low tax rates. This minimum tax would apply only to the wealthiest 0.01 percent of households—those with more than $100 million—and over half the revenue would come from billionaires alone.

How the Billionaire Minimum Income Tax Would Work

The minimum 20% tax would be on all of the income, including unrealized appreciation on investments.

The President's Fact Sheet: President’s Budget Rewards Work, Not Wealth with new Billionaire Minimum Income Tax explains how this tax would work:

If a wealthy household is already paying 20 percent on their full income – standard taxable income plus unrealized income – they will pay no additional tax under this proposal. If tax-free unrealized income allows a wealthy household to pay less than 20 percent on their full income, they will owe a top-up payment to meet the 20 percent minimum. As a result, this new minimum tax will eliminate the ability for the unrealized income of ultra-high-net-worth households to go untaxed for decades or generations.

The proposal allows wealthy households to spread initial top-up payments on unrealized income over nine years, and then five years for top-up payments on new income going forward. Stretching payment over multiple years will smooth year-to-year variation in investment income, while still ensuring that the wealthiest end up paying a minimum tax rate of 20 percent. Illiquid taxpayers may opt to pay later with interest.

In effect, the Billionaire Minimum Income Tax payments are a prepayment of tax obligations these households will owe when they later realize their gains. This approach means that the very wealthiest Americans pay taxes as they go, just like everyone else, and eliminates the inefficient sheltering of income for decades or generations.

Billionaire Minimum Income Tax Would Reduce Deficit

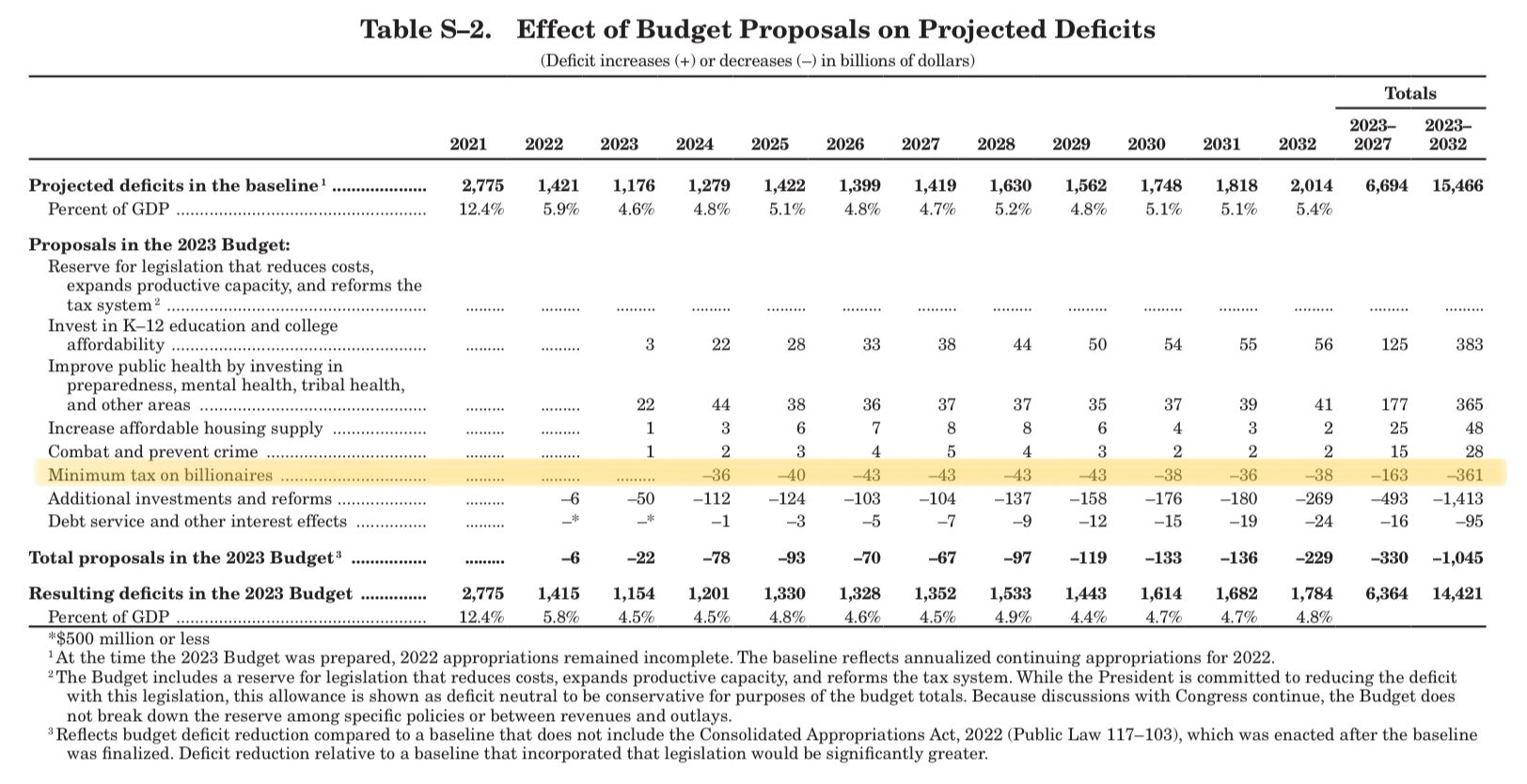

According to a summary table, the new billionaire tax would decrease the deficit by $361 billion from 2023 to 2032:

Criticism of the Billionaire Minimum Income Tax

Although some millionaires are "patriotic" and want to pay more taxes,[2] the Billionaire Minimum Income Tax is unlikely to pass.[3] Even if it passes, billionaires are likely to dodge the tax because they can afford a cadre of the best advisors who can assist them in exploiting loopholes in the law.[4]

The Billionaire Minimum Income Tax sounds like a gimmick:

- It is written to appeal to the average American who is likely to believe that billionaires own assets just as they do -- directly. In reality, billionaires are more likely to own assets through an array of complex legal structures. But most people support a tax on billionaires.[5]

- Further, even if it is enacted, the Billionaire Minimum Income Tax would likely be repealed by a future Republican administration that adheres to supply-side economics.[6]

See Christina Wilkie, Biden's 2023 budget would hike taxes on the ultra-rich and corporations, boost defense and police spending, CNBC, March 28, 2022 (Apple News link) (summarizing Biden's 2023 budget). ↩︎

Dominic Rushe, Tax the rich: these one percenters want people like them to pay higher taxes, The Guardian, April 8, 2022 (Apple News link) (discussing Patriotic Millionaires, a group founded in 2010, and President Biden's proposal of new taxes on households worth more than $100m). ↩︎

See Kate Dore, Why Biden’s billionaire minimum income tax may be a tough sell, CNBC, March 31, 2022 (Apple News link); Kate Dore, There’s a growing interest in wealth taxes on the super-rich. Here’s why it hasn’t happened, CNBC, April 9, 2022 (Apple News link) (stating, "like previous wealth tax proposals, the plan may struggle to gain broad support, with possible legal issues if enacted, policy experts say."). ↩︎

Ben Steverman, How Advisers to America's Ultra-Rich Plan to Win on Taxes, Again, Bloomberg Businessweek, April 7, 2022 (Apple News link) (discussing the Heckerling Institute on Estate Planning, and stating, "Heckerling is all about following the law, not violating it. But rich taxpayers can save much more money by exploiting the rules’ many gray areas—if, that is, they and their attorneys can tolerate the risks of triggering an audit and a legal challenge."). ↩︎

Americans for Tax Fairness, Biden's Agenda, Senator Ron Wyden's Billionaires Income Tax, March 23, 2022 (stating, "The public overwhelmingly supports the Billionaires Income Tax (BIT). Polling shows it enjoys the support of large majorities across the country. Nearly two-thirds (64%) of likely voters support the tax, including 61% of Independents. The BIT increases the popularity of President Biden’s investment and tax plan by up to 40 points in battleground states and congressional districts, especially among undecided independent voters."). ↩︎

See Talia Kaplan, Laffer slams Biden billionaire tax plan: Rich people the 'solution,' not the 'enemies', FoxBusiness, April 4, 2022 (Apple News link). ↩︎

Hani Sarji

New York lawyer who cares about people, is fascinated by technology, and is writing his first book, Estate of Confusion: New York.

Leave a Comment