The nonpartisan Joint Committee on Taxation (JCT) plays a critical role in shaping U.S. tax policy by providing Congress with detailed revenue estimates for proposed changes to the tax code. These estimates help lawmakers understand the fiscal impact of their proposals and make informed decisions.

In Revenue Estimating Process January 2025 (January 28, 2025), the JCT outlines its methodologies, models, and quality controls for producing revenue estimates. This post highlights the key elements of the JCT’s approach, including how it models taxpayer behavior, accounts for macroeconomic impacts, and ensures the accuracy of its estimates.

What is a JCT Revenue Estimate?

A JCT revenue estimate compares projected federal revenue under a proposed tax law with revenue projections under current law. These estimates are not based on current or past revenue levels but rather on a baseline of future revenue projections. For example, a proposal may result in higher receipts than current levels but still be considered a "revenue loss" if it generates less revenue than the baseline projection.

The JCT Revenue Estimating Staff

The JCT staff is an interdisciplinary team of 21 PhD economists, tax attorneys, accountants, and other experts. Their collaborative approach ensures that revenue estimates accurately reflect proposed legislation and incorporate realistic taxpayer behavioral responses. In 2025, the JCT staff provided over 2,700 revenue estimates for requests made during the 118th Congress.

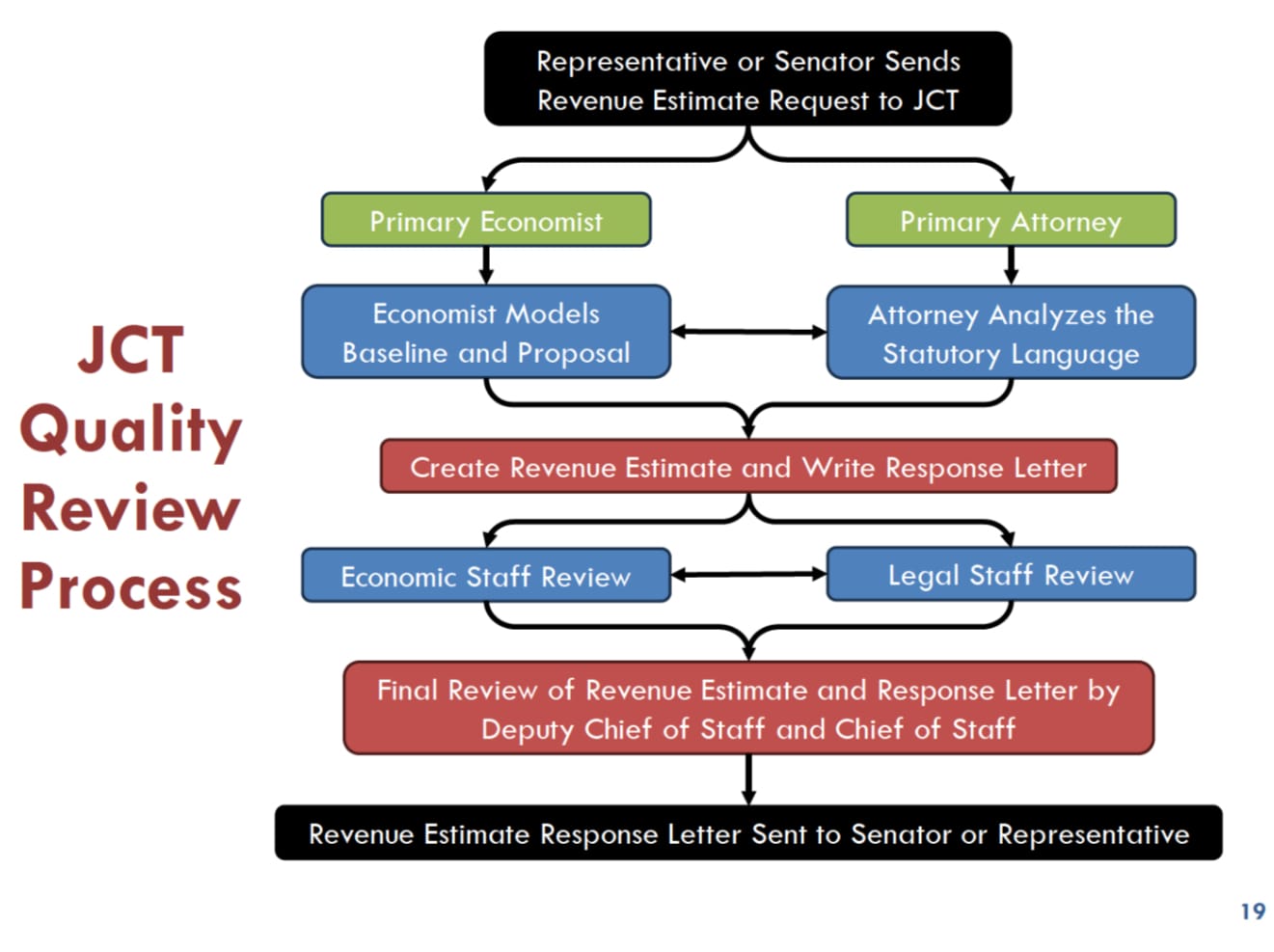

Quality Review Process

To ensure both accuracy and legal precision, the JCT follows a structured quality review process before releasing any revenue estimate. Once a Senator or Representative submits a request, a primary economist and a primary attorney begin the review. The economist models the baseline and proposed change, while the attorney analyzes the statutory language. Together, they draft the revenue estimate and response letter. This draft is then reviewed separately by economic and legal staff. Finally, the Deputy Chief of Staff and Chief of Staff conduct a final review before the estimate is sent back to the requesting Member of Congress.

(image)

(image)

How Are Revenue Estimates Requested?

Any Member of Congress can request a revenue estimate by submitting a written request to the JCT Chief of Staff. Requests must include sufficient detail about the proposal, even if it hasn’t been introduced as a bill. All requests are treated as confidential and discussed only with the requesting Member’s office.

JCT Tax Models

The JCT uses a variety of tax models to simulate taxpayer behavior under current law and proposed changes. These models include:

- Individual Tax Model: Represents all 200 million U.S. tax filing units and incorporates data from IRS tax returns, demographic trends, and other sources.

- Corporate Tax Model: Focuses on corporate income tax.

- Foreign Tax Model: Analyzes cross-border business income.

- Estate and Gift Tax Model: Examines changes to estate and gift taxes.

- Excise Tax Models: Forecasts receipts from specific excise taxes.

Each model accounts for behavioral responses, such as changes in consumption, investment, and tax planning strategies.

Behavioral Responses in Revenue Estimates

JCT revenue estimates are dynamic, reflecting predicted taxpayer reactions to new laws. For example:

- Smokers may reduce consumption in response to higher tobacco excise taxes.

- Businesses may shift investments to tax-favored sectors.

- Individuals may accelerate income recognition ahead of tax increases.

These behavioral assumptions are grounded in economic theory, legal research, and empirical data.

Macroeconomic Analysis

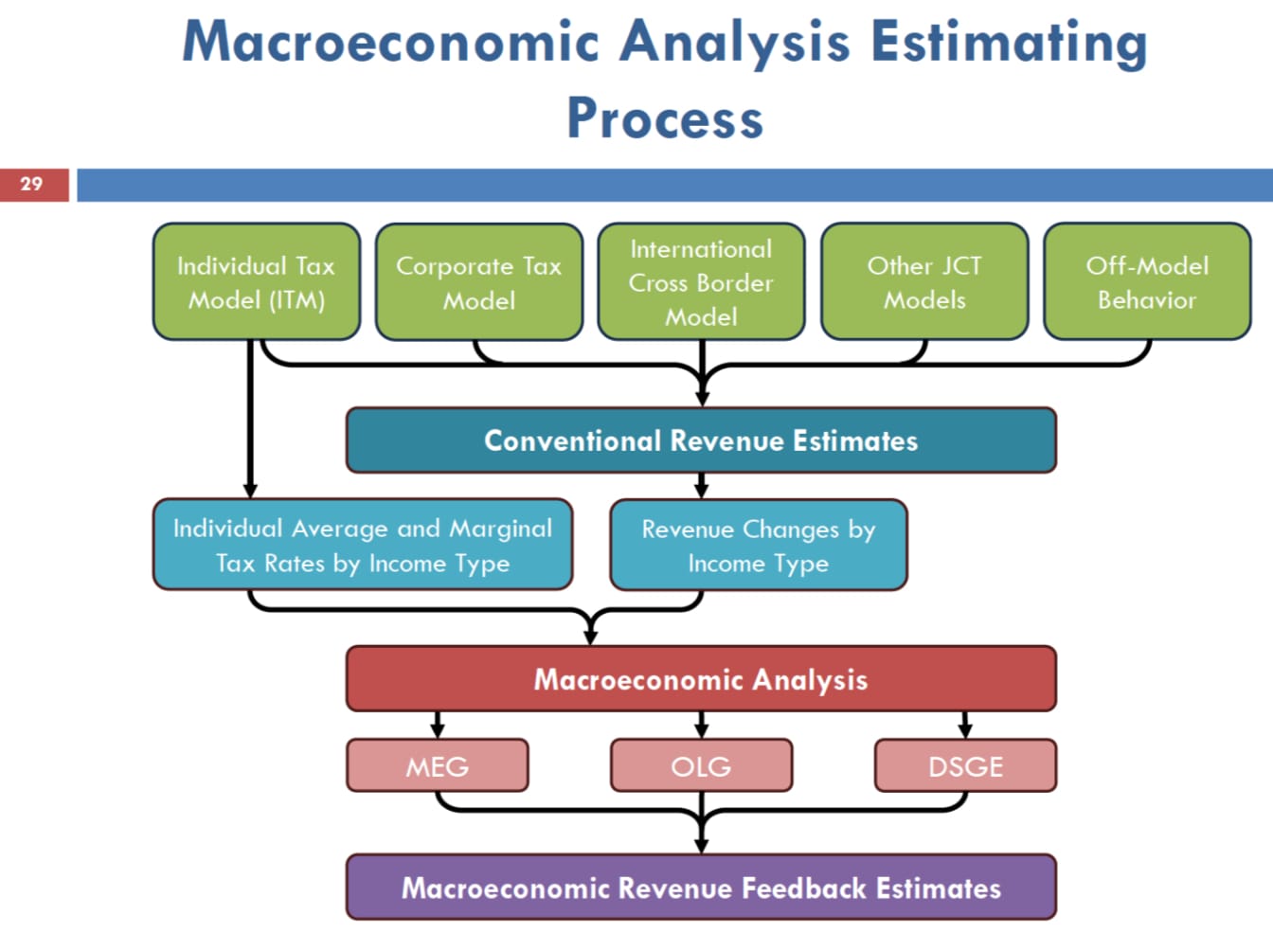

Since 2003, the JCT has provided macroeconomic analyses of tax policy proposals. These analyses estimate how proposed legislation might affect the overall economy, including GDP, employment, and investment. The JCT employs three macroeconomic models:

- MEG Model: Focuses on short-term dynamics and limited taxpayer foresight.

- OLG Model: Examines long-term impacts using a life-cycle approach.

- DSGE Model: Analyzes monetary policy interactions and fiscal sustainability.

Each model is calibrated to represent the U.S. economy and provides complementary perspectives on policy changes.

This process is part of a larger analytical workflow. The JCT begins with data from multiple tax models, including the Individual Tax Model, Corporate Tax Model, and others. These inputs are used to calculate conventional revenue estimates and assess changes by income type. The results feed into macroeconomic models, which generate macroeconomic revenue feedback estimates—used when required by House rules.

Example Analyses

The JCT has conducted notable analyses, such as:

- Tobacco Excise Tax Increase (2009): Estimated 1.5 billion fewer packs of cigarettes sold annually due to higher taxes.

- 2020 CARES Act Stimulus Payments: Predicted $292 billion in economic impact payments, closely aligning with actual Treasury data.

- Tax Cuts and Jobs Act (2017): Projected a 0.7% average GDP increase over 10 years, with $451 billion in macroeconomic revenue feedback.

Requesting a Revenue Estimate

Members of Congress can request revenue estimates by following these steps:

- Address the request to Thomas A. Barthold, Chief of Staff, Joint Committee on Taxation.

- Provide supporting documentation and sufficient detail about the proposal.

- Include contact information for the Member’s office handling the request.

- Submit the request via email, inter-office mail, or hand delivery.

Conclusion

The JCT revenue estimating process is a cornerstone of U.S. tax policy development. By combining rigorous economic modeling, interdisciplinary expertise, and behavioral analysis, the JCT ensures that lawmakers have the data they need to craft effective and fiscally responsible legislation. Whether analyzing excise taxes, stimulus payments, or sweeping tax reforms, the JCT’s work provides invaluable insights into the economic and fiscal impacts of proposed policies.

Hani Sarji

New York lawyer who cares about people, is fascinated by technology, and is writing his next book, Estate of Confusion: New York.

Leave a Comment