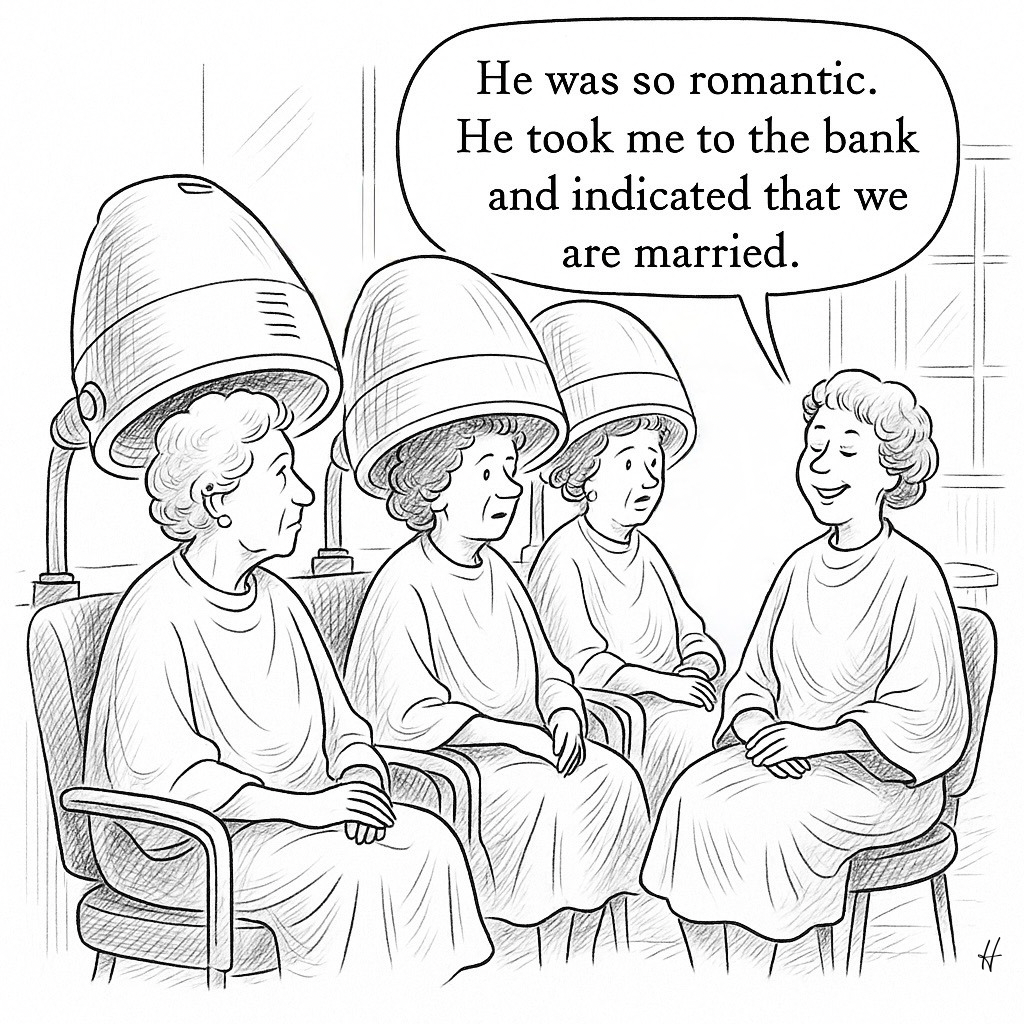

New York Assembly Bill A08549-A proposes a major change in how joint bank accounts are treated under New York law.

It creates a new category—spousal joint accounts (proposed BL § 675-a)—which include automatic survivorship rights. But here’s the catch: only married couples can open these new accounts.

For everyone else—siblings, friends, unmarried partners—joint ownership with survivorship is no longer the default. Instead, these relationships are limited to non-spousal accounts (proposed BL § 675-b), where the depositor remains the sole owner during life and no survivorship rights attach unless expressly added.

This shift is likely to increase probate filings. That’s not a speculative worry—it’s a predictable result supported by behavioral economics.

Behavioral economists Richard H. Thaler (Nobel Prize, 2017)[1] and Cass R. Sunstein (Holberg Prize, 2018)[2] have shown that people overwhelmingly stick with default settings.[3]

This insight has been confirmed in many contexts—from organ donation[4] to retirement savings. When the law shifts the default, human behavior reliably follows.

If those promoting the bill are aware of this and choose not to address it, then it’s fair to infer that this result is either intended or acceptable to them.

Richard H. Thaler: Facts, The Nobel Prize. ↩︎

Michelle Deakin, ‘One of the great intellectuals of our time’: Sunstein honored with Holberg Prize, Harvard Law Today, June 6, 2018. ↩︎

Richard H. Thaler & Cass R. Sunstein, Nudge: The Final Edition (2021). ↩︎

Johnson & Goldstein, Do Defaults Save Lives?, Science, 2003. ↩︎

- NY 2025 A08549-A

- Behavioral Economics

- Convenience Accounts

- Defaults

- Estate Planning

- Estates

- Financial Rights

- Joint Accounts

- LGBTQ Finance

- Married Couples

- New York

- NY Banking Law

- NY Bills

- NY BL § 675

- NY BL § 678

- Probate

- Relationship Equality

- Unmarried Couples

Hani Sarji

New York lawyer who cares about people, is fascinated by technology, and is writing his next book, Estate of Confusion: New York.

Leave a Comment