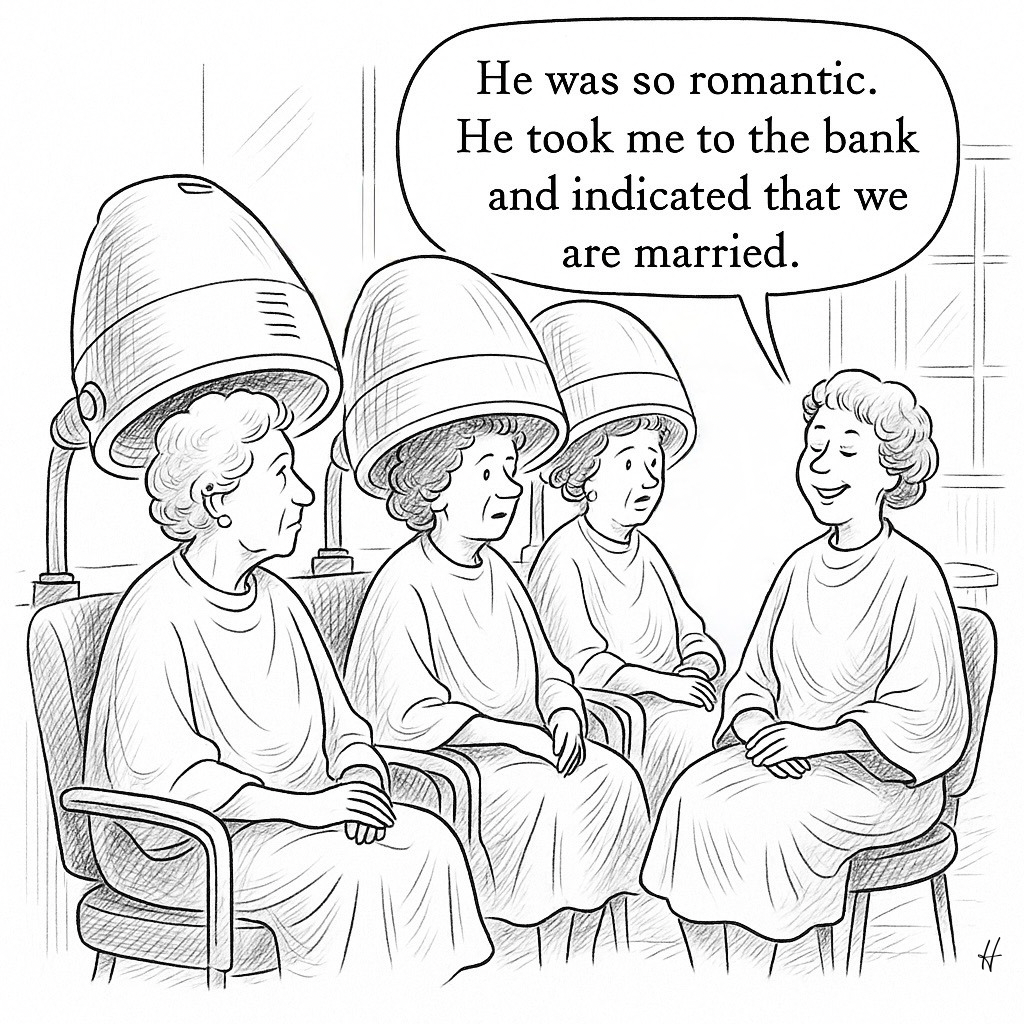

An "I love you" will is a simplified last will and testament that leaves everything the testator owns that can pass via a probate estate to the surviving spouse. Despite its name, an "I love you" will might not be the best estate planning tool to show love to a spouse.

In It sounds sweet, but is so-called 'I love you' will the best protection for my loved ones? (Florida Today 2/11/2022), Steven J. Lacey highlights the downsides of an "I love you" will, which include:

-

Does not avoid probate

-

Does not plan for the possibility of the surviving spouse's disability or developing special needs. For example, it provides no management, as a trust does, in case the spouse becomes disabled or incapacitated.

-

Doesn't consider children, grandchildren, or other loved ones, which are crucially important considerations for second and later marriages.

-

Provides no Medicaid (or VA) benefits since all of the assets that the surviving spouse receives are countable for Medicaid and VA purposes.

-

Does not control or consider testamentary substitutes, such as life insurance policies, bank accounts, or retirement accounts with completed beneficiary designations. Testamentary substitutes sometimes hold the most value in a decedent's estate.

While an "I love you" will is appealing because of its simplicity, depending on the married couple's facts, a trust (revocable or irrevocable) might be a better estate planning tool. Also, as Lacey suggests, a good estate plan is a comprehensive one that considers both probate and non-probate assets.

Hani Sarji

New York lawyer who cares about people, is fascinated by technology, and is writing his next book, Estate of Confusion: New York.

Leave a Comment