View Update History

- 9/10/2024: I rewrote this post with new information from several counties. Please note that, so far, Erie County is the only exception since it is requiring TP-584 but not RP-5217.

- 9/26/2024: Added Jefferson County.

- 9/27/2024: Updated requirements for Erie County.

- 10/7/2024: Niagara County is also requiring ancillary documents.

- 11/3/2024: (1) Added additional requirements in Nassau County, and (2) revised the Exceptions section.

Introduction

TODDs Generally

In New York, Transfer on Death Deeds (TODDs) became effective on July 19, 2024, following their enactment earlier this year in a budget bill. They are codified under Real Property Law section 424.

A Transfer on Death (TOD) deed is a legal document that allows property owners to designate beneficiaries who will inherit their real estate upon the owner’s death. This type of deed bypasses the probate process, which can save beneficiaries time, money, and stress. The property owner retains full control over the property during their lifetime and can revoke or change the TOD deed at any time before their death.

The Question: Are Ancillary Transfer Docs Needed?

There are numerous unanswered questions surrounding TODDs. One question is starting to be answered: Are ancillary transfer documents (TP-584, RP-5217, or IT-2663) required when recording TODDs?

General Answer: Not Needed

Generally, counties are not requiring ancillary documents when recording TODDs. See Statements by Home Abstract Corp and Thoroughbred Title Services. Several New York counties have updated their procedures to state that ancillary documents are not required for TODDs: Chautauqua County, Cortland County, Jefferson County, Monroe County, Richmond County, and Suffolk County.

Exceptions

Counties Requiring Ancillary Documents: There are two exceptions that I have confirmed: Erie County and Niagara County are requiring ancillary documents. (Note that we might learn about other exceptions.)

Counties with Peculiarities:

- Nassau County requires an additional clause in the TODD form and charges a fee.

- Richmond County has a special procedure to avoid recording ancillary documents.

Counties

Chautauqua County

Recording a Transfer on Death Deed states:

Tax documents (TP-584, RP-5217, and IT-2663) will not be required to record a T.O.D.D. as the transfer has not yet occurred, and there is no legislation requiring it at this time.

Cortland County

A July 17, 2024 PDF on the Cortland County Clerk's website states, "Not Required: TP-584, RP-5217 or IT-2663." However, it also notes, "My office has not received any official correspondence from New York State Taxation and Finance nor Real Property in regards to what their expectations are with this amendment."

Erie County

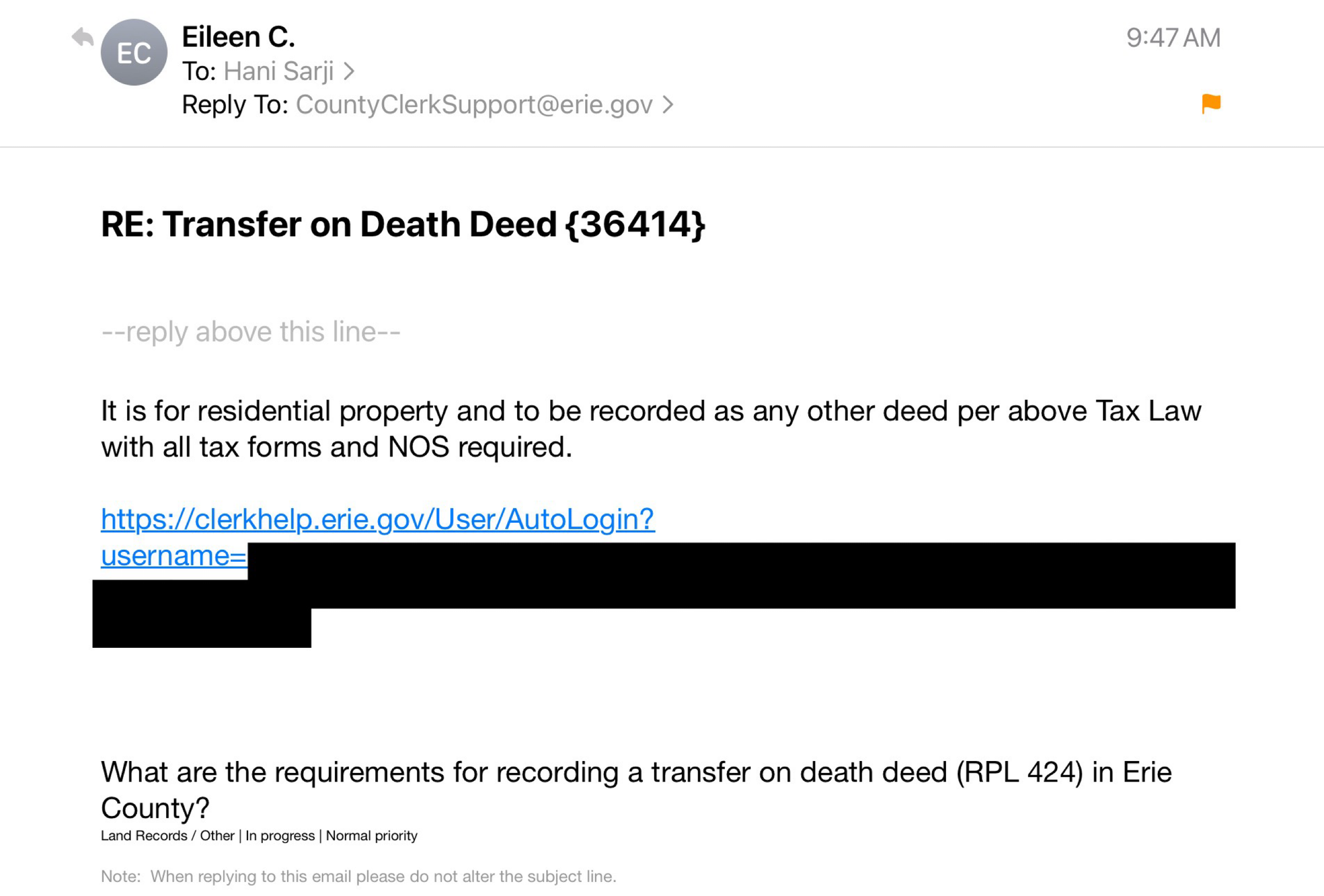

Erie County has not published its requirements for recording a transfer on death deed, but on September 27, 2024, they responded by informing me that a TODD is to "be recorded as any other deed per above Tax Law with all tax forms and NOS required." (Before today, we thought that Erie County was requiring form TP-584 but not RP-5217.)

Previously, on September 10, 2024, I sent the Erie County Clerk Helpdesk a message asking for clarification because the statute also says that a TODD is "effective at the transferor's death." They curtly replied, "We are following the instructions of our legal deputy."

Jefferson County

The Jefferson County Clerk's Office informs, "At this time a TP-584 & RP-5217 is NOT required, and a Notice of Transfer will not be mailed, as this document is not presently changing ownership of the property."

Here is the relevant part of the Transfer on Death Deed Information Sheet from the Jefferson County Clerk's Office:

While there seems to be overwhelming consensus among real property attorneys and other land tile professionals that the newly created Transfer on Death Deeds do not require transfer documents such as the NYS TP-584, and RP-5217, it must be noted that as of this date, there has been no guidance on this issue from either the New York State Department of Taxation, or the NYS Office of Real Property Services.

As a ministerial executive officer, this Office—performing its duties as County Register—lacks the legal authority to impose filing requirements which are not specifically supported by statute or administrative rule. Additionally, it has been the long-standing policy and practice of the Office of the Jefferson County Clerk that we will not substitute our legal judgement for the legal judgment of attorneys representing the parties to a transaction.

Therefore, until and unless the New York State Department of Taxation, and/or the NYS Office of Real Property Services specifically mandate to the contrary, a Transfer on Death Deed presented for recording will be processed as follows:

• A Transfer on Death Deed will be Recorded as Deed – TODD. At this time a TP-584 & RP-5217 is NOT required, and a Notice of Transfer will not be mailed, as this document is not presently changing ownership of the property.

Monroe County

Policy Statement for the Recording of Transfer on Death Deed, last revised July 30, 2024, states, "Discussions with NYS Tax & Finance have indicated that there is no expectation of a TP584/RP5217 with this recording."

Nassau County

I learned from Jean Patridge (Founder and Chief Counsel, Benchmark Title Agency, LLC) and Keith Madden (Underwriting Counsel & Vice President, Stewart Title Insurance Company) that Nassau County has two additional requirements.

(1) TODD Form. Nassau County requires this clause in the TODD form:

On this XXXX day of XXXXXX, 2024, WITNESS1 and WITNESS2 signed as

witnesses in front of TRANSFEROR.

(2) Fee. Nassau County charges a Tax Map Verification fee when recording a TODD. Effective April 23, 2023, this fee is $270, reduced from $355. See Kathleen Hennessy, Nassau County Tax Map Verification Letter Fee Reduction, Stewart Title Insurance Company, May 1, 2023.

Niagara County

On October 7, 2024, I confirmed by phone with the Niagara County Clerk's office that Niagara County requires ancillary documents, including TP 584 and RP 5217, when recording transfer on death deeds.

Richmond County

Policy Statement for the Recording of Transfer on Death “Deeds” (TODD), updated August 1, 2024, states:

This Office has been made aware that the New York City Department of Finance is not requiring the filing of transfer documents when a Transfer on Death 'Deed' [Real Property Law § § 424] (hereinafter 'TODD') is presented to the City Register for recording.

Guided by the policy of the New York City Department of Finance, this Office—as County Register for Richmond County—likewise will not require transfer documents for the recording of TODD.

Recording Tips from the Richmond County Clerk

Richmond County gives good advice on recording a TODD. It recommends selecting "other" when recording a TODD because selecting "deed" will require ancillary documents. The Richmond County Clerk's website states:

Whereas Real Property Law § 424 appears to not create a present conveyance of an interest in real property, the TODD should be submitted as document type “other” when preparing a Richmond County Endorsement Page. Doing so will require the payment of statutorily mandated recording fees only.

Lastly, as it has been the long-standing policy and practice of the Office of the Richmond County Clerk that we will not substitute our legal judgement for the legal judgment of attorneys representing the parties to a transaction, persons intending to record the instrument as a “deed” should select document type “deed” when preparing a Richmond County Endorsement Page. However, doing so will require the submission of all transfer documents typically associated with a deed (along with the filing fees and taxes—if any-- for those associated documents) and statutorily mandated recording fees.

Suffolk County

The Suffolk County Clerk's website states, "Ancillary transfer documents (RP-5217, TP-584, CPF), shall not be required when recording."

Westchester County

Thoroughbred Title Services informs that Westchester County has a new document type:

Title Companies

Home Abstract Corp

Home Abstract Corp informs that all counties in New York will not require ancillary documents:

TODDs can be recorded without any accompanying TP 484, RP 5217 or ACRIS Transfer Tax Documents (collectively “Transfer Tax Forms”) in all New York Counties. NOTE – The Offices of all County Clerks and City Registers in New York State are updating their recording procedures specifically related to TODDs so as to permit recordings without the Transfer Tax Forms. . . .

Thoroughbred Title Services

Thoroughbred Title Services states, "You will NOT need a TP-584 or RP-5217 to record it."

My Thoughts

The removal of the requirement for ancillary transfer documents when recording TOD deeds in New York simplifies the recording process significantly. Without the need for forms like TP-584, RP-5217, or IT-2663, the administrative burden on property owners and their legal representatives is reduced. This change can expedite the transfer process, aligning with the law’s intent to provide an accessible and cost-effective method for individuals, particularly those with limited financial resources, to transfer real estate upon death.

Consequently, I think that Chautauqua County has the right interpretation: "Tax documents (TP-584, RP-5217, and IT-2663) will not be required to record a T.O.D.D. as the transfer has not yet occurred, and there is no legislation requiring it at this time." I also think that Erie County's interpretation myopically focuses on a few words in RPL § 424 while ignoring the many ways the statute distinguishes TODDs from traditional deeds.

It is important to remember that TODDs in New York are a recent development, and we are continually learning more about their implementation and implications. The Cortland County notice's observation is important to keep in mind: "As with implementation of a change in the law, information sometimes becomes available following the effective date."

If you're interested in learning more about TODDs, I will be publishing an ebook on them:

Hani Sarji

New York lawyer who cares about people, is fascinated by technology, and is writing his next book, Estate of Confusion: New York.

Leave a Comment