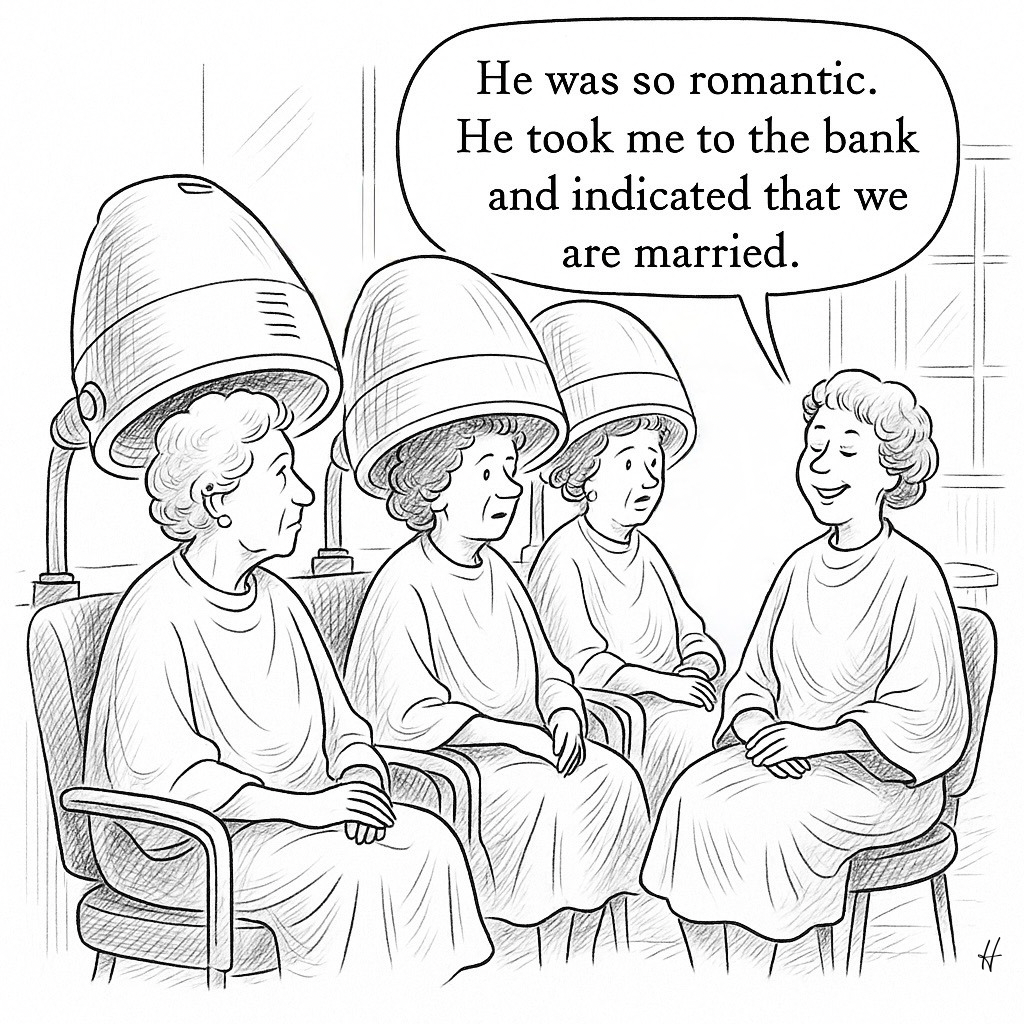

This cartoon might make you laugh—until you realize it’s rooted in real legislative language currently under consideration in New York.

Assembly Bill A08549-A would overhaul the state’s rules for joint bank accounts. Under the proposed bill, only legally married couples could access a new form of ownership called a spousal joint account, which comes with automatic rights of survivorship. Everyone else—friends, siblings, unmarried partners—would be limited to non-spousal accounts, where ownership stays solely with the depositor while they are alive.

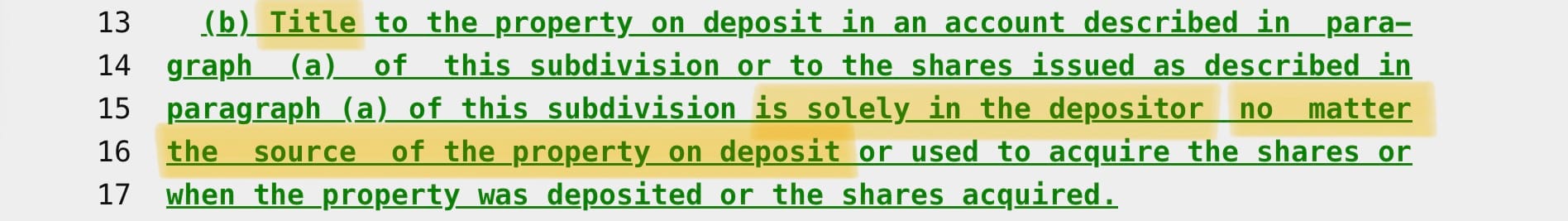

Under the proposal, two unmarried couples can contribute to the account, but there can only be one owner--the "depositor":

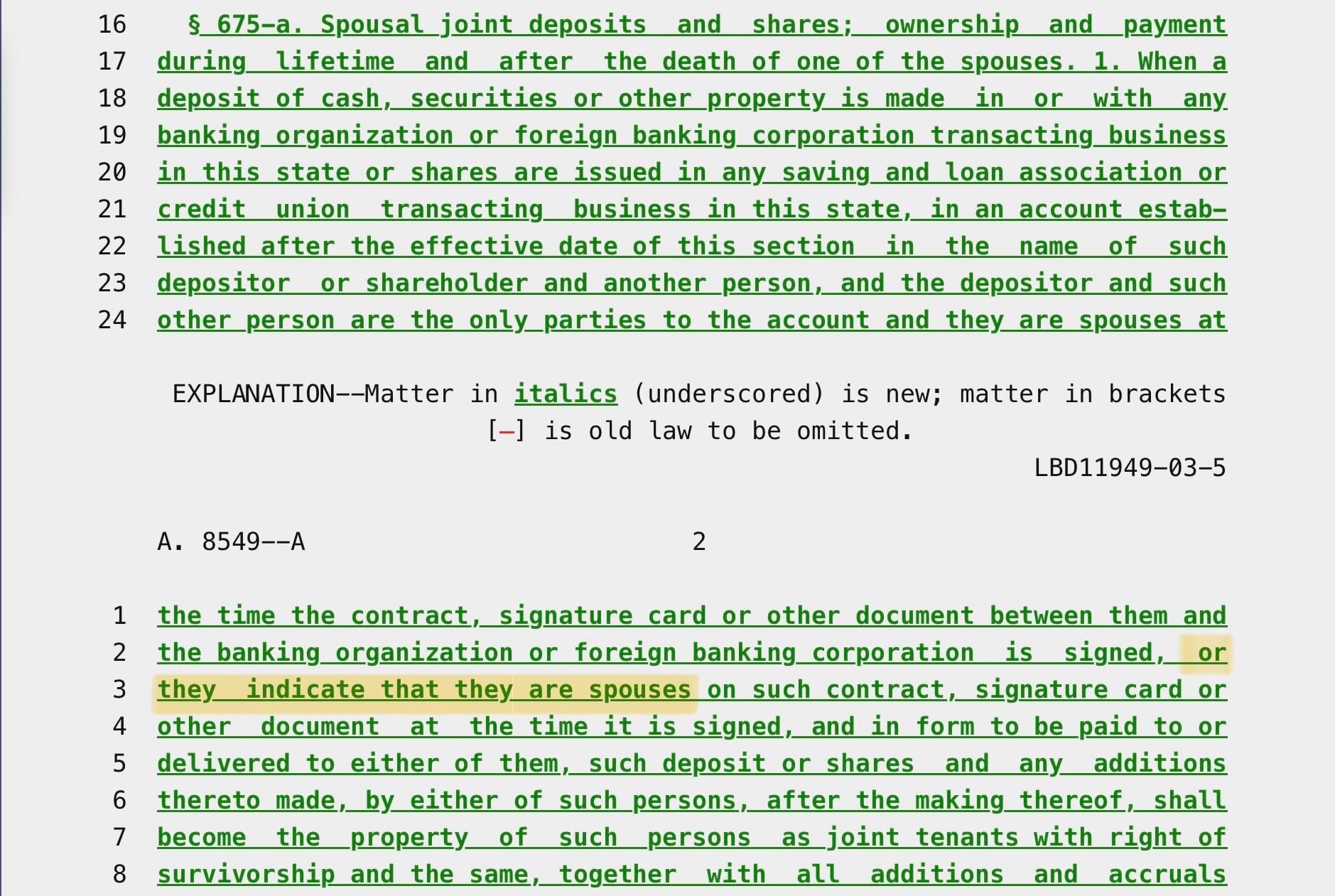

Drafters of the bill are aware of the bar against co-ownership of an account by unmarried couples, so they cleverly added a "loophole." Any two people can simply indicate to the bank that they are married:

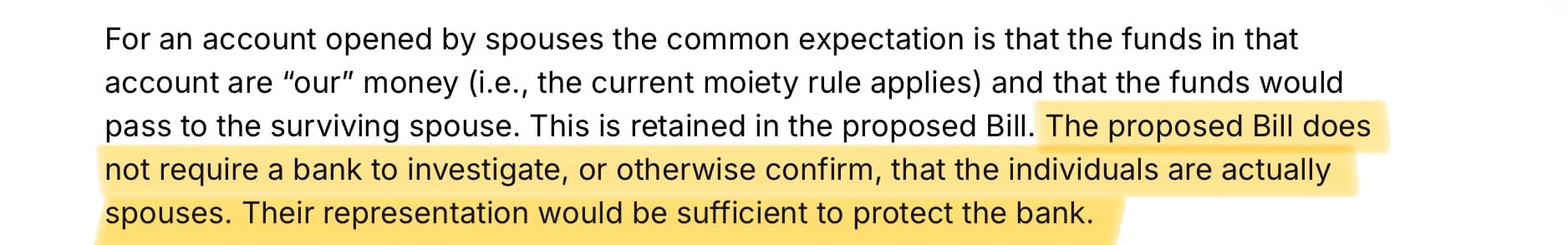

Yes, you read that correctly, the bill condones lying to banks. The bill actually says that a spousal joint account may be created if the parties "indicate that they are spouses" on the bank’s contract. No proof of marriage. Just a check-the-box representation.

A New York City Bar Association memo in support of the bill underscores the "loophole":

Why This Matters

The proposed changes would mark a major departure from the current law, which presumes joint ownership when two names are on the account—regardless of marital status.

A08549-A would change that landscape dramatically:

- Married couples would retain the right to open true joint accounts with survivorship.

- Unmarried partners, even in long-term relationships, could no longer co-own an account—even if they both contribute to it.

- Survivorship would be available to non-spouses only if explicitly opted into. All other non-spouse accounts would have to pass through probate.

A Quiet Redefinition of Property Rights

This isn’t just a technical update. It’s a redefinition of what it means to co-own property in New York. It privileges marital status in a way that seems out of step—especially in a state that has long recognized the rights of unmarried partners and LGBTQ+ couples.

In the wake of Dobbs v. Jackson Women’s Health Organization and renewed national conversations about the fragility of constitutional rights, it’s hard to ignore the broader implications. Many fear that marriage equality itself could be revisited. Against that backdrop, narrowing property rights based on marital status is not only outdated—but poorly timed.

And because the bill has already received support from several bar association committees and the Surrogate’s Association, its path forward looks increasingly likely—unless those affected speak up now.

Closing Thoughts

This cartoon uses humor to underscore something serious: we should think carefully about the normative ideals our laws privilege and reinforce.

If you’re in a committed relationship but not legally married, or if you want to co-own a bank account 50/50 with a loved one who isn’t your spouse, this bill would restrict your options.

And if you’re a legal practitioner, this may affect how you advise clients—especially those who fall outside traditional marital categories. Will you inform clients about the “loophole” buried in the bill and suggest they can misrepresent their marital status to the bank?

The bill is moving forward with broad support. If these concerns aren’t raised now, the opportunity to shape its outcome may be lost.

After all, love may be blind, but not banking law.

Cartoon Commentary

The cartoon shows a group of women seated under vintage hair dryers in a salon, chatting casually. One woman, with a dreamy expression, says: “He was so romantic. He took me to the bank and indicated that we are married.”

The humor plays on the contrast between romance and bureaucracy—gently mocking the idea that a legal representation on a bank form could be mistaken for a marriage proposal. In doing so, it highlights the absurdity of a New York bill that would allow joint bank accounts for unmarried couples only if they “indicate” to the bank that they are married—turning a check-the-box requirement into a strangely intimate gesture.

🔗 Read the bill: Assembly Bill A08549-A.

- NY 2025 A08549-A

- Convenience Accounts

- Estate Planning

- Financial Rights

- Joint Accounts

- LGBTQ Finance

- Married Couples

- New York

- NY Banking Law

- NY Bills

- NY BL § 675

- NY BL § 678

- Relationship Equality

- Unmarried Couples

Hani Sarji

New York lawyer who cares about people, is fascinated by technology, and is writing his next book, Estate of Confusion: New York.

Leave a Comment