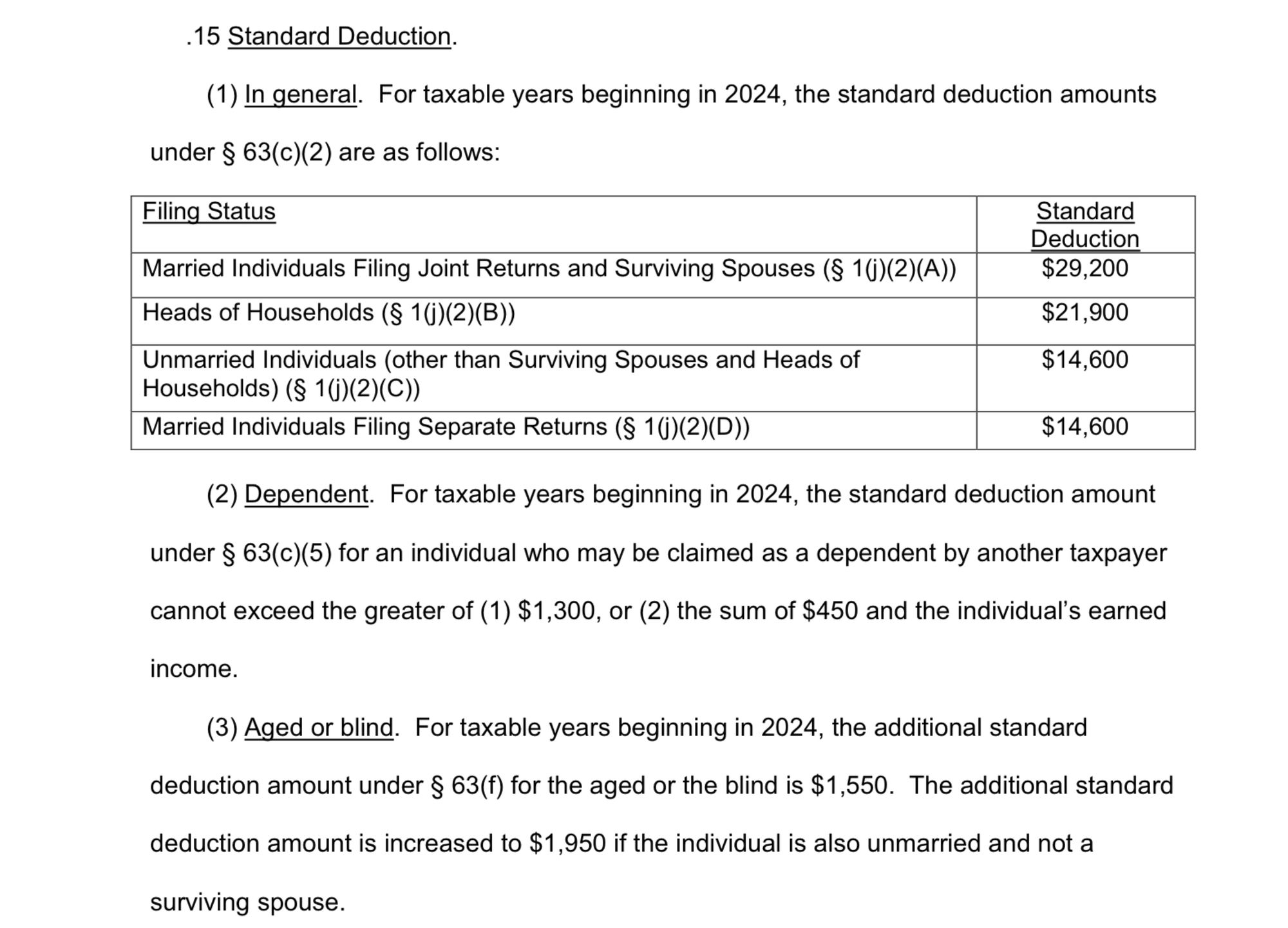

In Revenue Procedure 2023-34, the IRS released the standard deduction amounts for 2024.

The standard deduction is a set amount of money that you can subtract from your taxable income. This amount is determined by the government and is based on your filing status, such as single, married filing jointly, or head of household. By taking the standard deduction, you reduce the amount of income that is subject to taxation, which can lower your overall tax bill.

It's important to note that if you itemize your deductions, you may be able to deduct more than the standard deduction, but this can be more time-consuming and may not be worth the effort for everyone.

Also, with the increase in the standard deduction brought about by the Tax Cuts and Jobs Act (TCJA), fewer taxpayers are now itemizing their deductions. This is because the standard deduction is now high enough that many taxpayers find it more beneficial to simply take the standard deduction rather than to itemize. As a result, some deductions that were previously commonly itemized are no longer as valuable to taxpayers who are taking the standard deduction.

Hani Sarji

New York lawyer who cares about people, is fascinated by technology, and is writing his next book, Estate of Confusion: New York.

Leave a Comment